when are property taxes due in illinois 2019

Due Dates Tax Year 2021 Second Installment Property Tax Due Date. At one of many bank and credit union branches across Will County.

Untitled Exit Strategy Suburban Veterans Day

Tuesday March 1 2022.

. Even if the payment is. Penalty be assessed for payments made after the due date. Has yet to be determined.

Check to see if your taxes are past due. The second installment for the 2018 property taxes paid in 2019 is sept. Prepare your 2019 Illinois state return for 1799.

Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. September 4th The 2nd installment of Real Estate Taxes is due on September 4 2019. The Illinois Department of Revenue does not administer property tax.

In the second case taxes are due July 1 and January 1. The Second Installment of 2020 taxes is due August 2 2021 with application of late charges moved back to October 1 2021. Collecting property taxes on real estate and mobile homes.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. When this office receives that data we will be able to print and mail the bills. There are several convenient ways to pay your real estate property taxes.

January 1 2020 - New Years Day. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. County boards may adopt an accelerated billing method by resolution or ordinance.

While Illinois home values dropped property taxes increased by more than 51 alarming many homeowners. Due dates are June 6 and Sept. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Delinquent Property Tax Search. 2019 payable 2020 tax bills are being mailed May 1. The property tax due dates are April 30 and October 1 for the first and second half.

The Illinois Department of Revenue does not administer property tax. If taxes are not paid after the second installment date in addition to the penalty additional fees may be added. Scheduled to be held May 12 through May 18 2022.

Ad Free prior year federal preparation. While Illinois home values dropped property taxes increased by more than 51 alarming many homeowners. Will County Illinois Property Taxes Due.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Property tax due dates for 2019 taxes payable in 2020.

173 of home value. In person weekdays from 830 AM 430 PM at the. In the rest of the state the tax date varies by jurisdiction.

Property tax due dates for 2019 taxes payable in 2020. Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Property tax due dates for 2019 taxes payable in 2020.

Cook County and some other counties use this. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. In most counties property taxes are paid in two installments usually June 1 and September 1.

100s of Top Rated Local Professionals Waiting to Help You Today. In the calendar year 2019 we will be paying real estate taxes for the 2018 year. Enjoy online payment options for your convenience.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Property TaxesMonday - Friday 830 - 430. Ad Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert.

See Results in Minutes. Ad Enter Any Address Receive a Comprehensive Property Report. Free prior year federal preparation Prepare your 2019 state tax 1799.

The typical homeowner in illinois pays 4527 annually in property taxes. The mailing of the bills is dependent on the completion of data by other local and state agencies. Cook County Treasurers Office - Chicago Illinois.

The deadline for each quarterly instalment is July 1 October 1 January 1 and April 1. When are property taxes due in illinois 2019 Sunday March 6 2022 Edit. Discover the Registered Owner Estimated Land Value Mortgage Information.

It is managed by the local governments including cities counties and taxing districts. Search By Property Index Number PIN. Tax amount varies by county.

NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually. If you are a taxpayer and would like more information or forms please contact your local county officials. Corporate purposes general fund including amounts for fire protection ambulance services and imrf.

General Information and Resources - Find information. The county seat. Welcome to Madison County Illinois.

January 1 2020 - New Years Day. In most counties property taxes are paid in two installments usually June 1 and September 1. Will County is located in the northern part of Illinois and is one of the fastest-growing counties in the United States.

Learn how the County Board has kept the tax levy flat for Fiscal Years 2020. If you have delinquent taxes for Tax Year 2019 they will be offered at the 2019 Annual Tax Sale which begins May 12 2022.

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

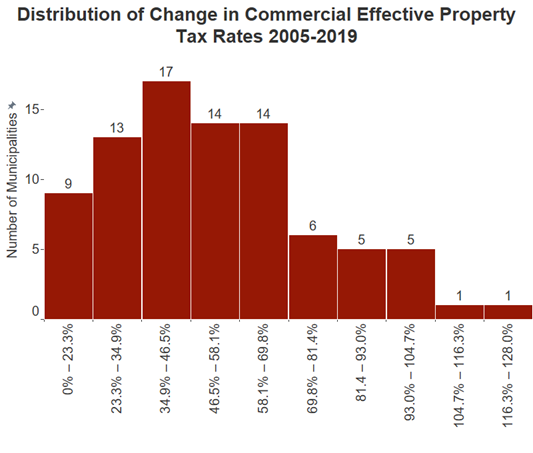

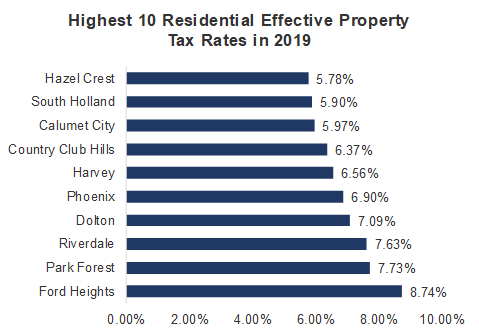

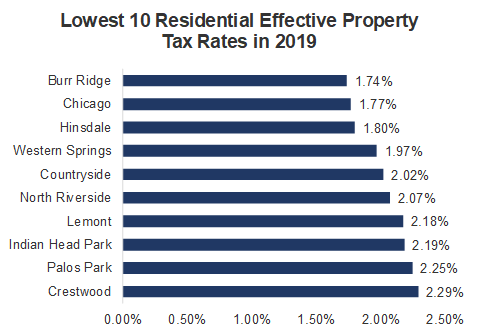

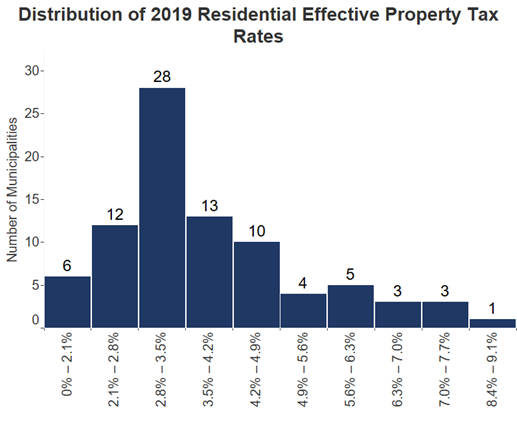

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Ranking Of Best Places To Buy A House In The Austin Area Market Based On Home Values Property Taxes And Austin Ar Houses In Austin Real Estate Home Ownership

Want To Become A Library Trustee And Join The Smrld Board Of Directors Board Of Directors Education Information How To Become

All You Have To Do Is Go On Catchfree Website And Browse To Cars Category And You Will Get And An Extensive List House Styles Real Estate Ads Real Estate

Primera Ins Tax Services On Instagram Tis The Season For Tax Preperation Did You Know The Easies Financial Institutions Tax Software Best Tax Software

State Corporate Income Tax Rates And Brackets Tax Foundation

Montgomery County Courthouse Sign In Hillsboro Illinois Paul Chandler February 2019

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Normal We Must Entertain And More Entertaining Government Organisation Community College